ST. GEORGE — Last month, Washington County sent tax notices to property owners detailing how much the county believes the property is worth and thereby what its taxable value is.

It’s not uncommon for some property owners to experience a sense of sticker shock when they receive these letters, with property taxes going up as much as 20% in some cases in just a year’s time.

Residents who believe the county has overestimated the taxable value of their home are provided recourse to appeal the rate and seek to have it lowered but only for a short window of time.

Protests over the taxable value of a property can be brought before the county’s Board of Equalization but typically only between Aug. 1 and Sept. 15. The taxable value of the property can only be protested for that particular year.

Following is look at how Washington County determines the taxable value of a property.

Anatomy of property taxes

Enter Washington County Assessor Tom Durrant.

“My responsibility is to assess everything at market value,” Durrant said while speaking to St. George News about his position, which is an elected county office.

States across the country vary in the ways they determine the assessed or taxable value of real property. In Utah, the market value of a property on Jan. 1 of a given year is used as a baseline in the assessment. Going into this estimate is a plethora of data, including aerial photographs, construction permits, mass appraisals of the surrounding area’s market value and more.

The estimated market value of the home as of Jan. 1 is the only date considered by the Assessor’s Office, as the market can fluctuate throughout the year, Durrant said.

Based on these factors, the Assessor’s Office determines the taxable value of the property, which is then sent to the Utah Tax Commission for review to make sure it stays within a state-required 5% range of the market value price. A home valued at $350,000 could see a gain or decrease within the range of $17,500.

From there, the data is sent to the office of Washington County Clerk Kim Hafen, who applies a tax levy to the assessed value of the property.

The tax levy consists of taxes issued by municipalities, counties and the state, as well as school districts and special service districts, like the Washington County School District and Washington County Water Conservancy District.

There are also taxing districts within the county that apply to specific areas, like the Hurricane Valley Fire District or special economic development zones where property taxes are set at a frozen rate for a number of years, such as in downtown St. George and the Fort Pierce Industrial Park.

Under state law, the taxing agencies are guaranteed revenue matching the amount set in their previous year’s budget, Hafen said, and they cannot collect any more or any less than that. This means that when the market is doing well, the tax levy will go down, as the agencies can’t take in more revenue, with the exception of taxes derived from new construction.

However, the opposite happens when the market slows. Guaranteed the same amount of money as the year before, the amount required by the tax levy remains the same, even while the assessed or taxable value based on the Jan. 1 market estimate has gone down.

In St. George, the tax levy has been going down steadily over the last five years as the property market has continued to rise, Hafen said.

The overall property tax rate for St. George dropped from 0.017 in 2014 to 0.01 in 2018. A home valued at $334,500 in 2014 would be taxed about $5,600, while the same home in 2018 would be taxed $3,325.

The property tax rate for 2019 has yet to be finalized, but a preliminary estimate puts it beneath 2018’s 0.01 rate, Hafen said.

While the price of the tax levy appears to be trending downward, the housing market continues skyward in Washington County and across the state.

Rising market

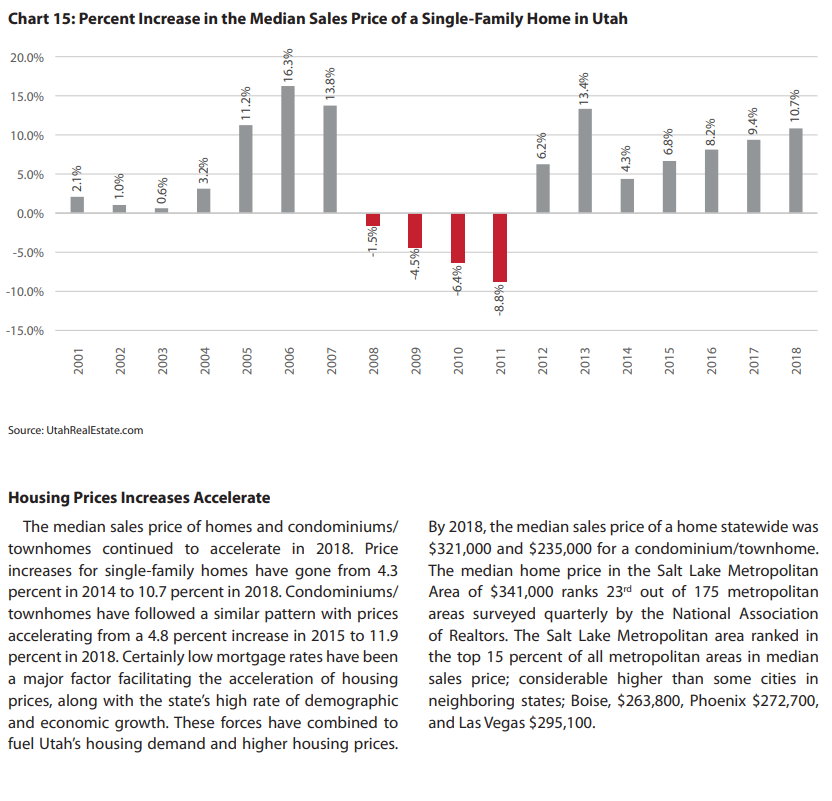

For the last four years, the Washington County Assessor’s Office estimated that property values in the county have climbed between 9-10% year-over-year.

According to a March 31 report from the Federal Housing Finance Agency detailing percentage increases in housing costs, the St. George area ranked in the top 20 metro areas with the highest rates of housing appreciation, with a one-year average of nearly 11% and a five-year average of 46.33%

The Washington County Assessor’s Office’ estimate is slightly lower, placing the county at an average increase of 41.3% for a four-and-a-half-year period leading to 2019.

According to the Housing Market Report 2018 from the University of Utah’s Kem C. Gardner Center released earlier this year, housing prices have skyrocketed since 2014. The median sales price of single-family homes jumped from 4.3% in 2014 to 10.7% in 2018. Townhouses and condominiums increased from 4.8% to 11.9% during the same period.

While homeowners may welcome the increased value a rising market gives their property, that rise also comes with additional property taxes. Given how high the market can go, in addition to other factors, it comes as no surprise when some property owners get sticker shock when they look at the tax notice sent out in July detailing their property valuations.

Other factors affecting property assessment

Durrant said there are a number of other factors that can lend to a home’s assessed/taxable value going up.

One such factor could include the Assessor’s Office not having the latest paperwork and information related to particular properties, such as a remodeling project that may not be assessed one year but is noticed for the purposes of property valuation the next year.

A home under construction is assessed on its completed percentage as of Jan. 1, while the following year it will be assessed on the completed project, potentially significantly increasing its taxable value.

Some residents may not have applied for a primary residential exemption for their home, which Durrant highly encourages. The exemptions allows a home on up to an acre of land to be assessed at 55% of its taxable value.

As the exemption must be applied for, realtors often include the application with paperwork associated with a home purchase.

How to appeal a property’s assessed value

Homeowners who find the market value assigned to their property to be in error can appeal it through the county’s Board of Equalization.

Applications for appeal, which can be found on the Washington County website, are accepted between Aug. 1 and Sept. 16 this year for the 2019 valuation of the assessed property.

Documentation recommended for the appeal include the settlement document, at least three documents detailing the sale of comparable properties and an appraisal.

“This is a great opportunity to get things right,” Durrant said of the appeal process.

The applicable documents and related items are reviewed by the Board of Equalization for the granting or denial of the plea.

If the property owner does not agree with the Board’s assessment, the decision can be appealed to the Utah Tax Commission.

Adel Murphy, the Assessor’s Office services division manager, stressed that the appeal is for that year’s assessed value only and does not impact the tax levy added to it.

The Washington County Assessor’s Office is located at 87 N. 200 East Suite 201 in St. George and can be contacted at 435-634-5703.

Copyright St. George News, SaintGeorgeUtah.com LLC, 2019, all rights reserved.