ST. GEORGE — Utah’s nonfarm payroll employment has grown by an estimated 2.4 percent over the past year, adding 35,100 jobs to the economy since September 2016. While Washington County’s current unemployment rate is slightly higher than the state’s, it is holding steady from last month and is still considered at “full employment.”

Approximately 53,800 Utahns were unemployed during September and were actively seeking work, while there were an estimated 1,481,100 Utahns employed, according to an Oct. 20 news release from the Utah Department of Workforce Services

“Utah’s labor market continues to expand, despite losing some momentum in the latter half of the year,” said Carrie Mayne, chief economist at the Department of Workforce Services. “Employers continue to add to their payrolls, with monthly expansion averaging 43,700 thus far in 2017.”

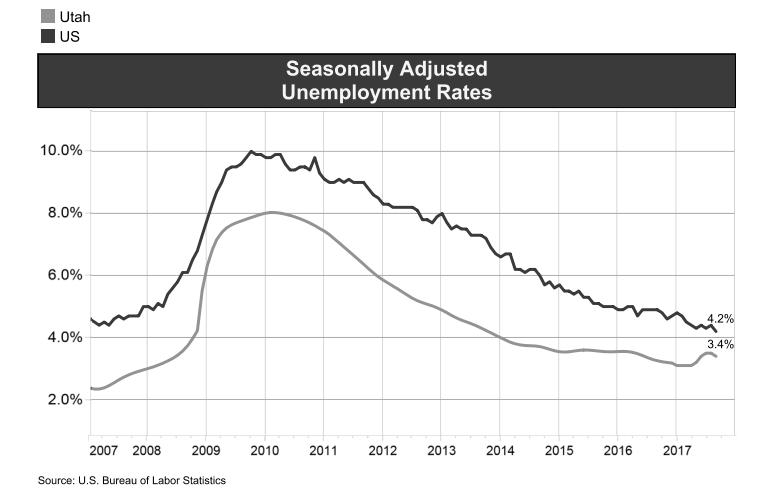

Utah’s seasonally adjusted unemployment rate dropped to 3.4 percent in September, down one-tenth of a percentage point from the previous month, according to the report. Meanwhile, the national unemployment rate decreased two-tenths of a percentage point from August to September, falling from 4.4 percent to 4.2 percent.

Washington County’s current unemployment rate is 3.5 percent, just slightly higher than the state average. It was unchanged from the previous month, the report said.

However, between June 2016 and June 2017 (the most recent hard data available), the county added more than 2,800 jobs for a growth rate of 4.6 percent, said Lecia Langston, senior economist at the St. George DWS office. This represents a higher job increase than the state for roughly the same time frame.

Additionally, Langston said, while Washington County may have a slightly higher unemployment rate than the state, it is still within the range that economists consider “full employment.”

“Strong employment growth coupled with low unemployment are indicative of a tight labor market,” Langston said. “In other words, many jobs are available and employers are having more difficulty finding workers with the desired skills. Of course, although there are many jobs available, they aren’t necessarily high-paying jobs. However, the tight labor market is putting upward pressure on wages in the area.”

“All of Washington County’s economic indicators — employment growth, unemployment, wages, construction and sales — show a very healthy economy at the current time,” she added.

Langston said the growth appears to be spread across several sectors of the economy.

“This is a broad-based expansion with most industries sharing in the job growth,” she said, adding, “This points to a sustainable expansion. Most recently, construction, health/social services and leisure/hospitality services (related to tourism) have shown the strongest job gains in recent months.”

Langston said Washington County’s manufacturing employment growth remains very strong in contrast to that sector’s current performance on the national level.

As for neighboring Iron County, Langston said it is also showing healthy signs of economic growth.

“Iron County came late to the job-growth party, but now appears on solid ground with job growth of 500 jobs (up 3 percent) between June 2016 and June 2017,” Langston noted, adding, “Most of its current employment expansion is in construction and manufacturing, although most industries are adding jobs. Although slightly higher than the state average of 3.4 percent, Iron County’s jobless rate of 4.2 is still relatively low with no sign of unseasonable layoffs.”

Utah’s private sector employment grew by 2.6 percent with the addition of 31,000 positions in September, the DWS report said.

Eight of the 10 private sector industry groups measured in a DWS tracking survey posted net job increases in September as compared to last year. The only two that did not show gains were the Natural Resources and Mining industry, which lost 500 positions and the Information industry, which lost 1,700 jobs.

According to the report, the largest private sector employment increases were in professional and business services (8,800 jobs); trade, transportation and utilities (6,400 jobs); and construction (4,700 jobs). The fastest employment growths by percentage occurred in construction (5.0 percent); professional and business services (4.3 percent); and in other Services (4.0 percent).

Resources

- Additional analysis and tables.

- Utah’s county-by-county unemployment rates for September 2017.

- Utah’s Labor Market and Economy blog.

Email: [email protected]

Twitter: @STGnews

Copyright St. George News, SaintGeorgeUtah.com LLC, 2017, all rights reserved.